The future for life sciences: renewables, refurbishment and retrofit?

Peter Wyld, Head of TFT’s Cambridge office, spoke with Property Week on the outlook for the life sciences sector in the near future. Life sciences defines much of the commercial property market in Cambridge, Oxford and the ‘arc’ region between the two cities, due to the close proximity of quality research talent and cutting-edge tools from neighbouring universities.

The sector is far from constrained to one area however. In London’s Canary Wharf, a development covering 750,000 sq ft will become the largest commercial life sciences building in Europe with wet-land facilities, on completion in 2026.

The UK biotech and life sciences industry has seen £4.5bn of investment in 2021 alone, and that stimulus will support expanding and improving their facilities. Primarily, purpose-built research parks will play the largest part in meeting those needs, but there is increasing opportunity in repurposing existing buildings to the sector’s needs too.

Peter Wyld, Cambridge office head highlights some key issues with finding the space for growth in the industry:

“The areas of investment in the UK where Life Sciences operations are located are invariably ‘talent hotspots’

This clustering of R&D companies intensifies pressure on the occupier market, putting a focus on buildings which provide high levels of quality amenities for occupiers and which are seen to be in the most desirable locations. It is not uncommon for occupiers to compete with each other for different ways to retain good quality talent. Constructing business parks or premises with these facilities takes years and requires confidence from investors. As such, offices with facilities where staff can eat, exercise and have access to healthcare are invariably in demand and space is rarely empty for long.”

“Long-term, guaranteed access to power supplies is becoming a major consideration for many investors who are starting to experience issues with the ability of network suppliers to provide timely and commercially viable power upgrades to meet increasing demands.

“Areas where development exceeds the rate in which infrastructure is strategically upgraded have suffered the most. This is particularly true around the Home Counties where distribution network operators are coming under increasing pressure. Power is usually more accessible nearer to large generation sites, for example Edinburgh and large parts of Scotland, which is a net exporter of power.

Quite a lot of UK wind energy is also generated in specific locations such as the Humber, giving nearby cities like Leeds an edge.

“Some investors are exploring on-site renewable options while others are looking to be smarter in the way in which occupiers of their assets use available power. There is also a growing de-gasification agenda with major institutions, which could be short sighted. Investment has been ramping up in Green Hydrogen, notably with announcements by Scottish Power at the Port of Felixstowe and French investment into Newcastle. Access to an alternative gas supply may help mitigate against infrastructure upgrade timelines where the future gas connection may be repurposed. In common with the onshore wind and solar market, there are already signs of landlords and owners seeking to ‘bank’ energy in a ‘first-come-first-served’ protocol.”

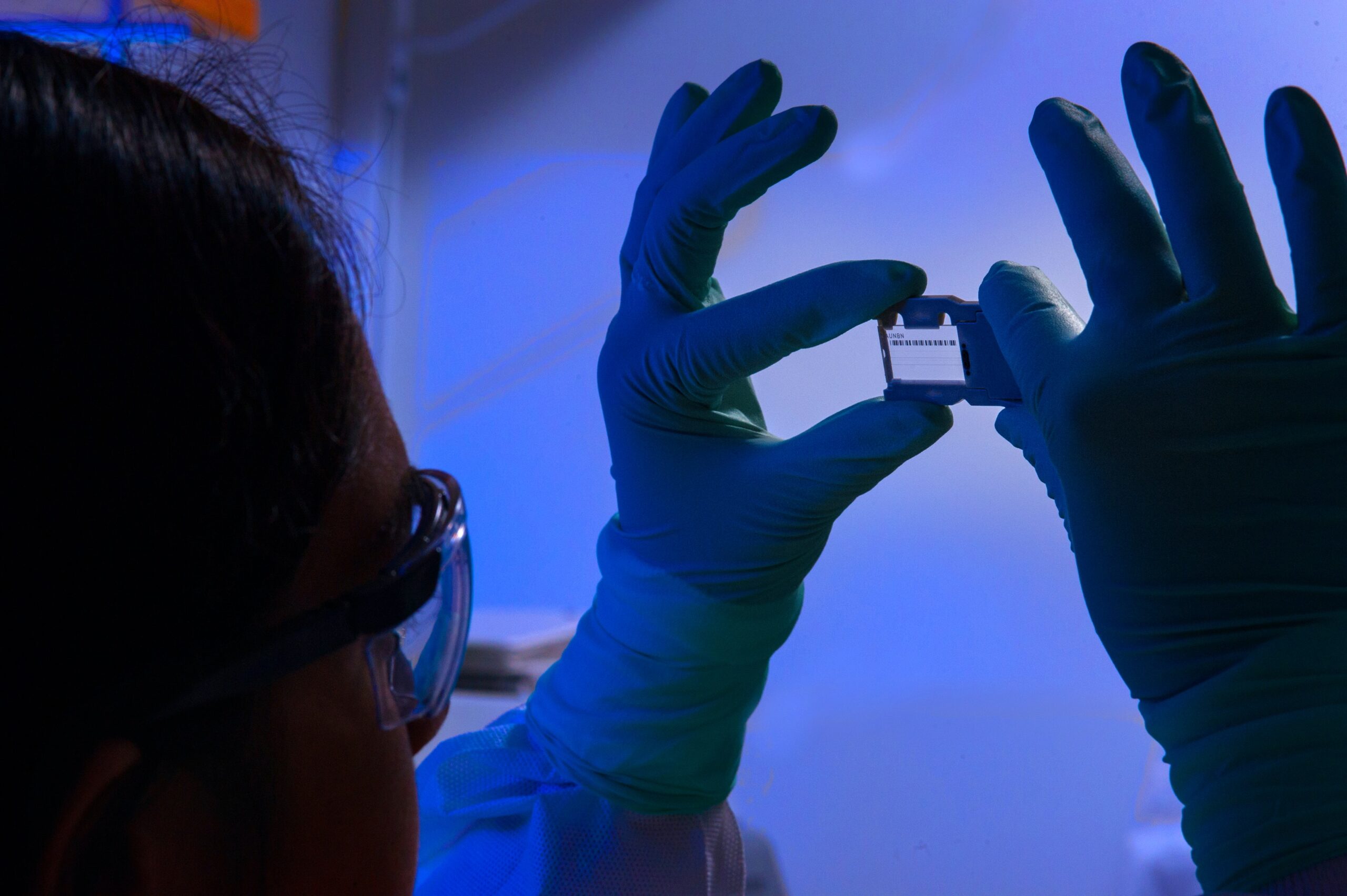

“The types of buildings required for Life Sciences facilities must be highly adaptable to the rapidly changing requirements of the sector which, in some cases, need to be addressed in months rather than years.

Specific requirements tend to include larger-than-typical floor-to-ceiling heights to allow for the rapid and regular circulation of air; enhanced drainage facilities to service wet-lab environments; and column-free office space, such as that delivered by TFT at 400 & 450 Longwater Avenue, in Green Park, Reading.

“While access to power remains a fundamental concern for any business, given the capital outlay involved in upgrading services it is understandable why developers will install only what is needed to meet immediate needs. Greater consideration should be given to future flexibility and potential gas connections – at least while gas continues to be a part of the national energy strategy – or else to hydrogen stores to supplement lower electrical capacities. External plant rooms built into planning applications from the outset, for example, can help to minimise power risks for occupiers in the future.”